BRAIN PROPRIETARY STRATEGIES

Systematic investment strategies are built as demo use cases for the Brain datasets. Each strategy is based on one or more Brain datasets, without additional inputs. In practice more custom or complex strategies can be constructed using several datasets as building blocks, potentially in combination with traditional financial and economic data.

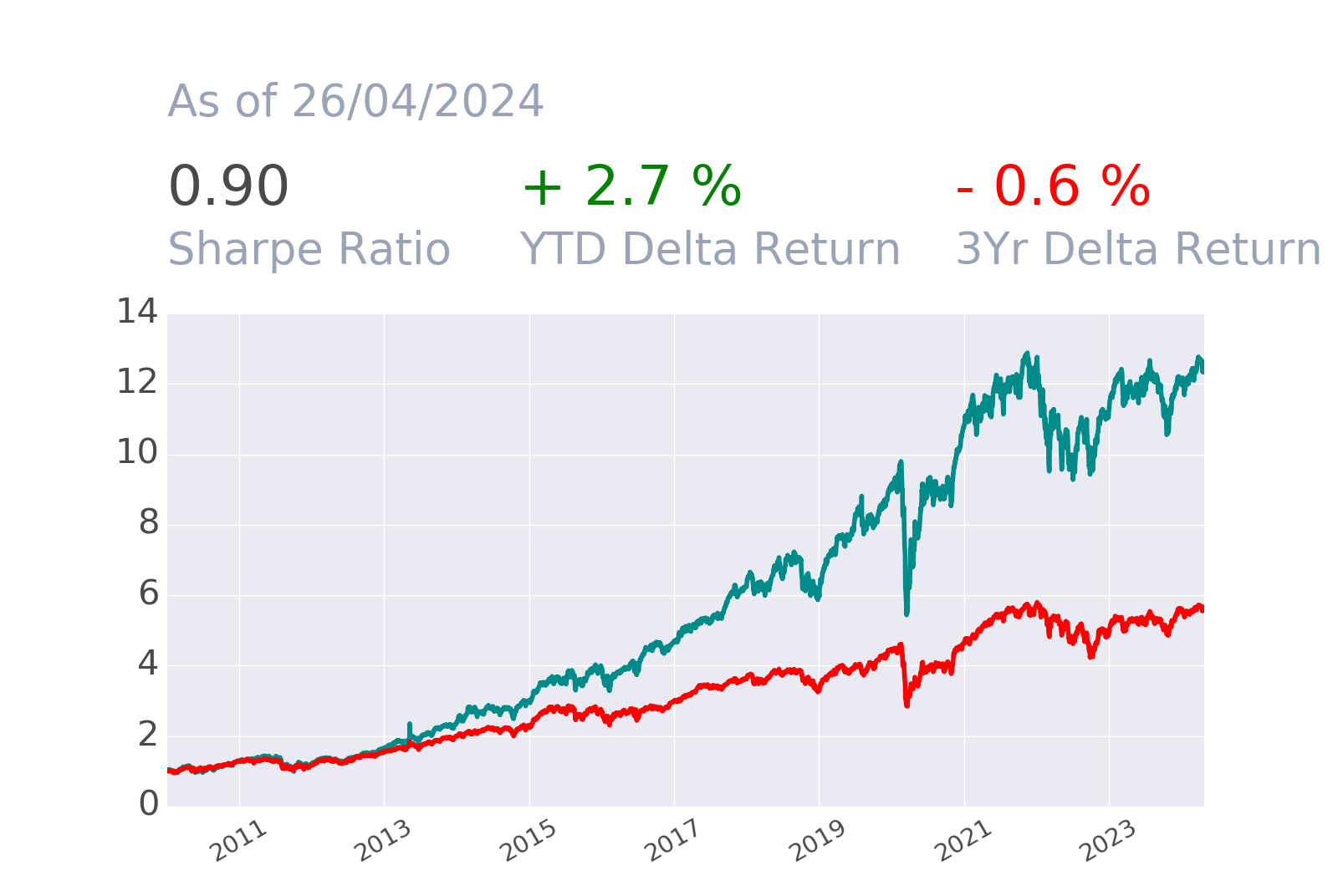

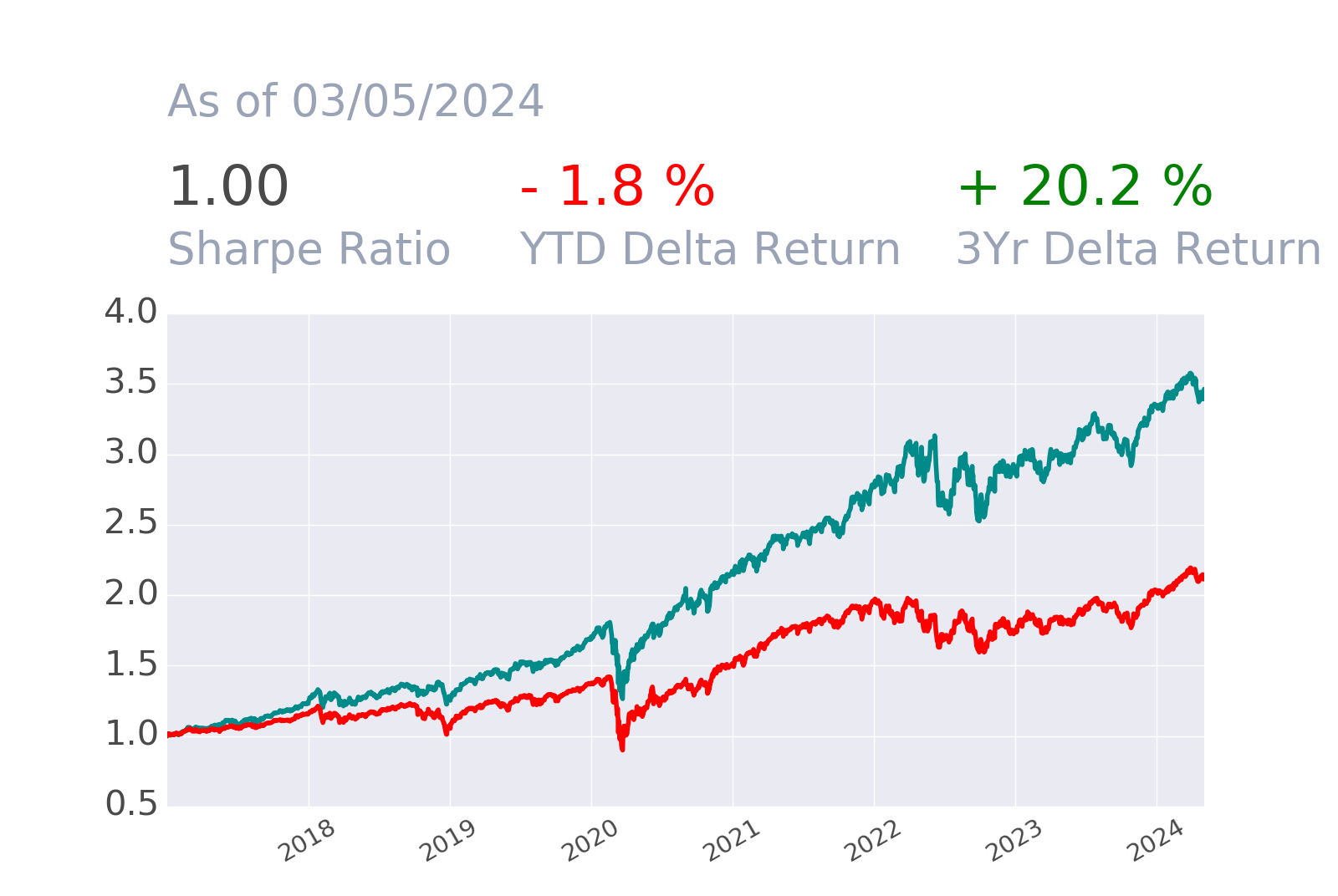

Brain A.I. Europe Top 10

Top 10 stocks selected amongst the 600 highest market cap European stocks through the Brain Machine Learning Stock Ranking dataset, with uniform weights and monthly rebalancing. A benchmark is built using the equally weighted components of the investment universe. The performance of the strategy (blue line) and of the benchmark (red line) with the main metrics are shown in the picture below. Commissions are not included.

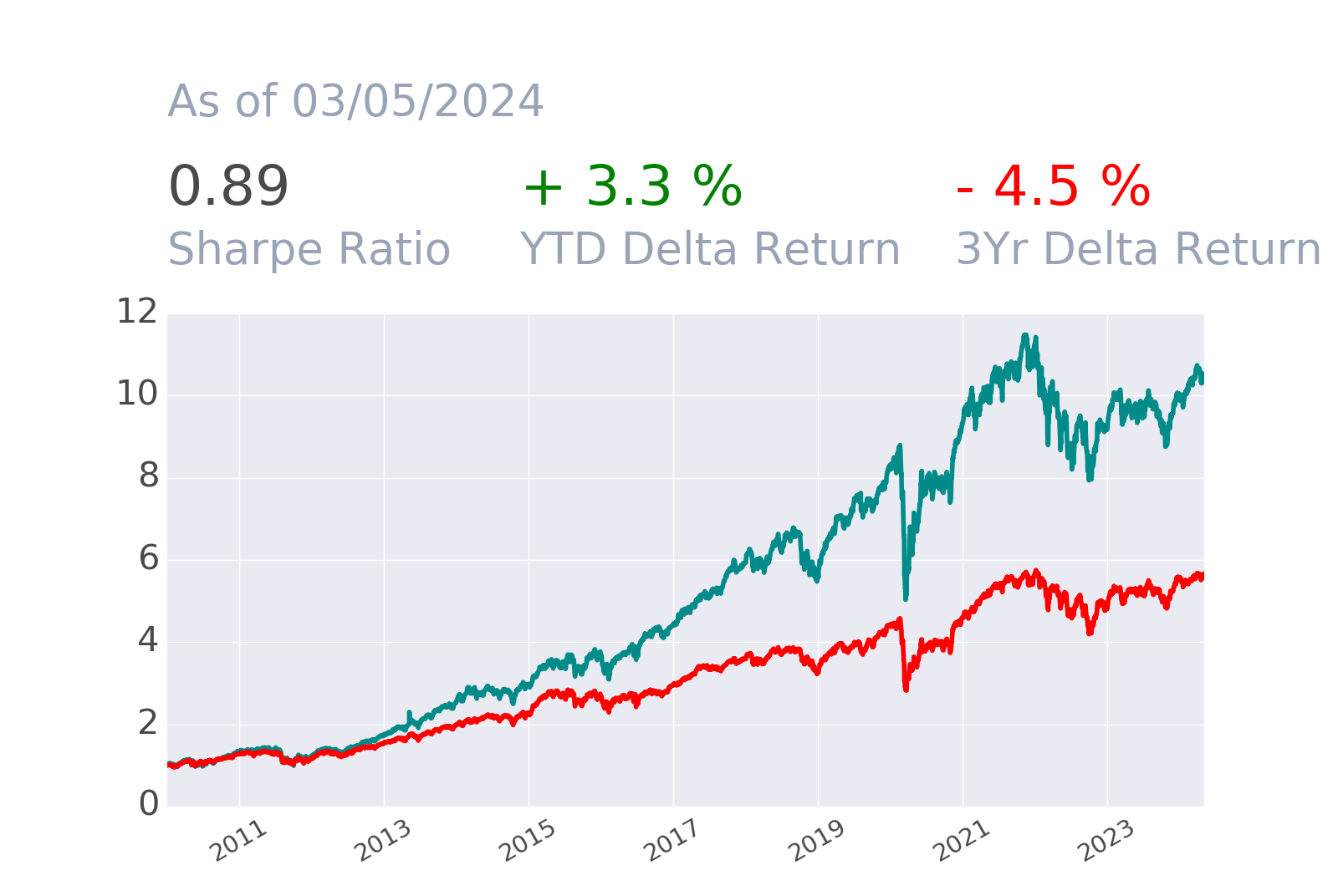

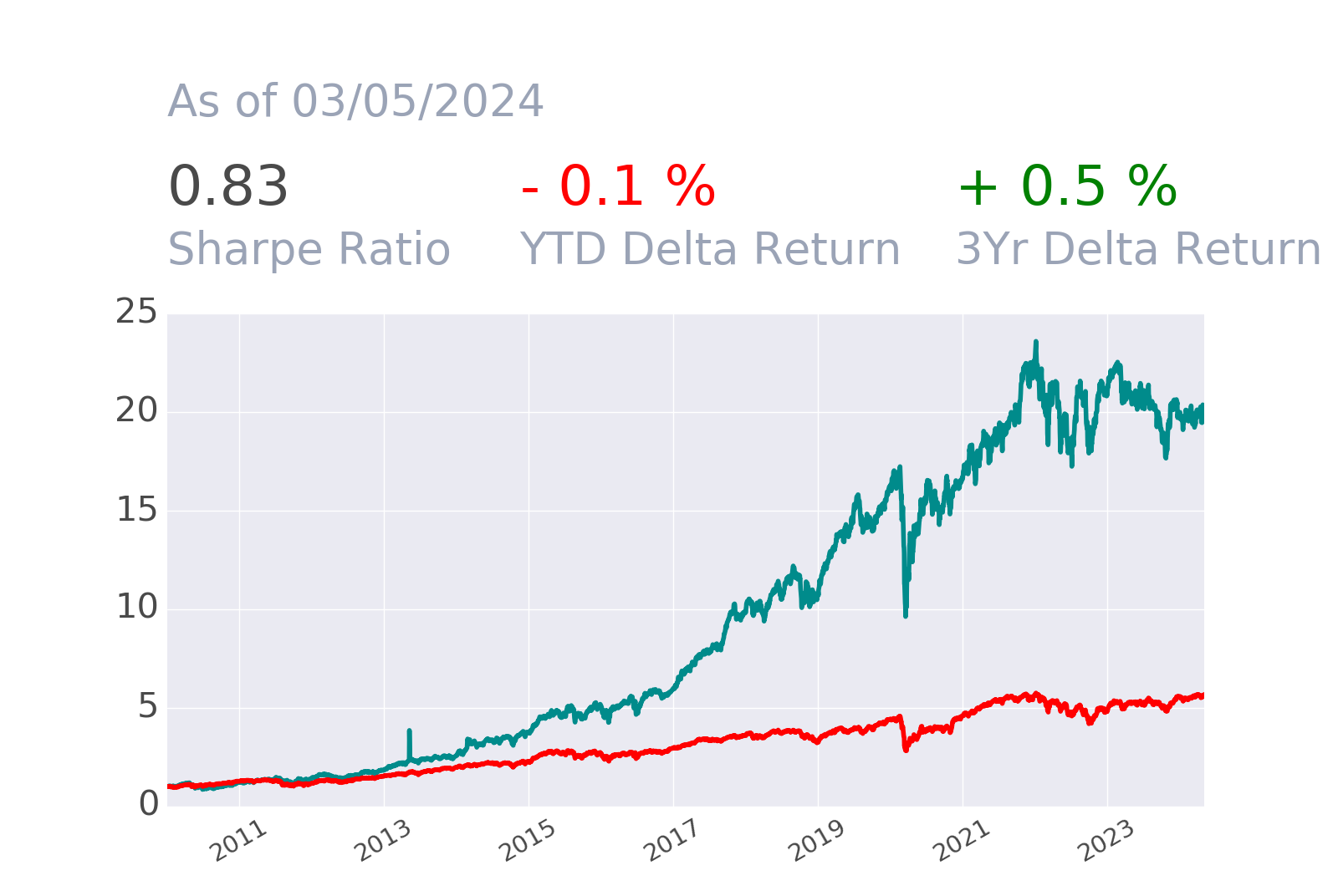

Brain A.I. Europe Top 30

Top 30 stocks selected amongst the 600 highest market cap European stocks through the Brain Machine Learning Stock Ranking dataset, with uniform weights and monthly rebalancing. A benchmark is built using the equally weighted components of the investment universe. The performance of the strategy (blue line) and of the benchmark (red line) with the main metrics are shown in the picture below. Commissions are not included.